Recent discussions surrounding cryptocurrency regulation have frequently highlighted the contrasting positions of former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo and current Securities and Exchange Commission (SEC) Chair Gary Gensler. Giancarlo recently quashed rumors regarding his potential future roles in government, specifically regarding the SEC and crypto-related positions within the US Treasury. His clear stance reflects a desire to distance himself from the current regulatory tumult entwined with the crypto sector, which he describes as a “mess.” This term, in Giancarlo’s context, likely refers to the SEC’s controversial “regulation by enforcement” approach—a strategy that has been criticized internally and externally for being overly aggressive and lacking clarity.

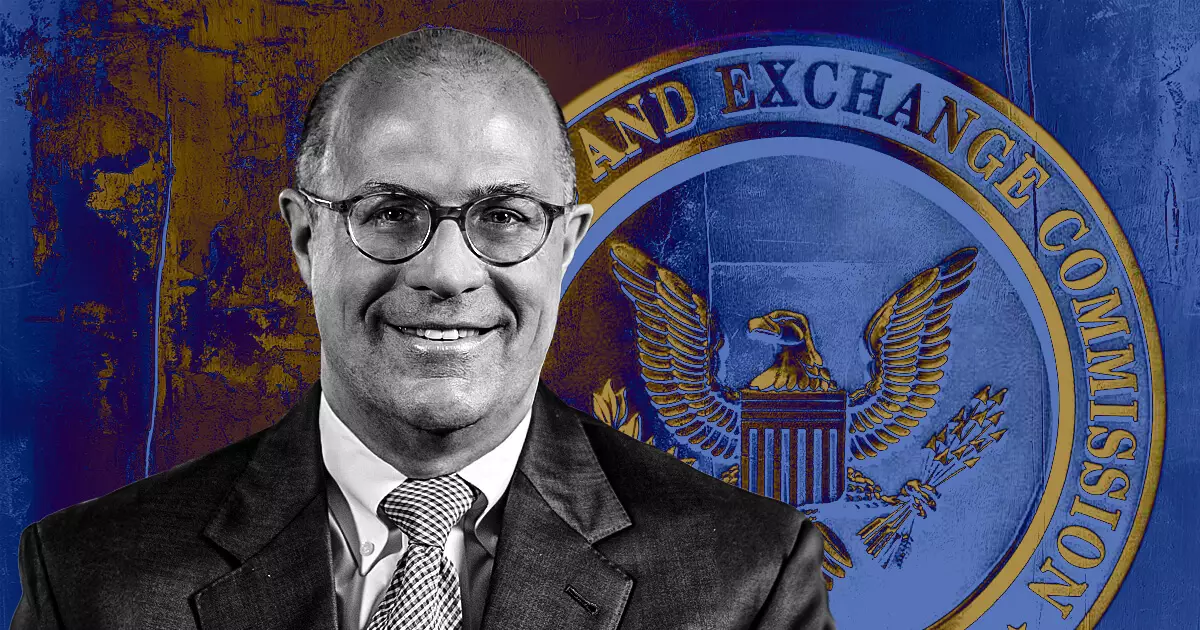

Giancarlo’s tenure at the CFTC began in August 2017, a pivotal moment leading into a crypto boom that required nuanced regulatory oversight. Known affectionately in the crypto community as “Crypto Dad,” he has garnered respect for promoting a relatively favorable stance towards digital currencies. His memorable assertion that “cryptocurrencies are here to stay” in 2018 marked him as a forward-thinking leader at a time when skepticism prevailed. Conversely, Gensler’s approach at the SEC has been characterized by a dragon-slaying mentality, attacking perceived legal loopholes within the crypto landscape. He has articulated that while Bitcoin may not fit the definition of a security, a vast number of alternative cryptocurrencies do and therefore fall under SEC jurisdiction.

During a recent address at the Practising Law Institute’s annual conference, Gensler defended the SEC’s firm regulatory framework. He articulated the notion that the SEC’s dedication to oversight is vital to safeguard investors and maintain market integrity. His claims regarding the number of digital assets likely qualifying as securities seem to be moving the crypto industry toward more rigorous compliance, asserting that many firms must register to protect consumers. Gensler’s emphasis on preventing “significant investor harm” illustrates an intent to curb the growing risks associated with poorly regulated digital assets, but it has also ignited controversy within the crypto community.

Since Gensler’s ascendance to the SEC, numerous lawsuits against key players in the crypto sector, including prominent exchanges like Kraken and Binance, have emerged, prompting a backlash. Industry advocates argue that the SEC’s harsh measures have stifled growth and innovation rather than nurturing a maturing cryptocurrency landscape. Critics contend that without clear regulations, companies face an uphill battle in navigating an ever-changing legal framework, making it difficult to keep pace with both domestic and global developments in the digital currency sphere.

The unfolding dynamics of regulation within the cryptocurrency space necessitate a delicate balance between investor protection and industry growth. As Giancarlo steps back and Gensler continues to assert control over the regulatory narrative, stakeholders within the crypto sector are poised at a critical juncture. The outcome of these persistent tensions and regulatory frameworks will ultimately shape the future trajectory of cryptocurrency in the United States, revealing whether more collaborative efforts or continued enforcement will dominate this burgeoning financial sphere. The path ahead remains fraught with challenges, requiring adept navigation of both regulatory policy and the evolving landscape of digital innovation.

Leave a Reply