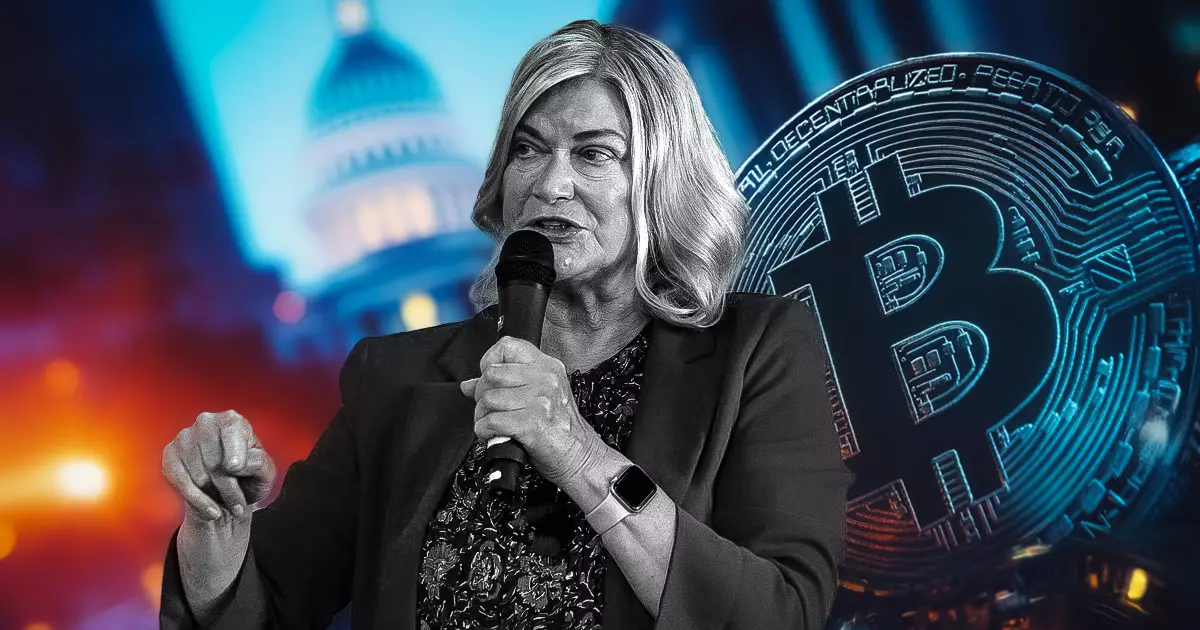

In a significant move for the cryptocurrency sector, Senator Cynthia Lummis (R-Wyo.) has been appointed as the inaugural chair of the Senate Banking Subcommittee on Digital Assets. This announcement, made on January 23, marks a pivotal point in the U.S. government’s approach to blockchain technology and cryptocurrencies. Under the leadership of Senate Banking Committee Chair Tim Scott (R-S.C.), Lummis is tasked with spearheading the creation of a regulatory framework that could define the future of digital finance in America.

Known for her unwavering support of Bitcoin, Lummis regards digital currencies as integral to America’s financial future. She has famously remarked that, “Digital assets are the future,” highlighting the urgency for Congress to adopt bipartisan legislation that solidifies a comprehensive legal foundation for these technologies. Her vision extends beyond merely regulating cryptocurrencies; she advocates for a national Bitcoin reserve that could enhance the U.S. dollar’s strength and position the country as a frontrunner in the global cryptocurrency landscape.

The newly formed subcommittee under Lummis’s leadership is set to prioritize several critical areas, including market structure, consumer protections, and stablecoins. The objective is clear: to establish a balanced and fair regulatory environment that enables innovation while safeguarding consumers’ rights. A notable point of emphasis will be overseeing federal financial regulators to ensure they adhere to established guidelines and avoid potential overreach, such as initiatives seen as “Operation Chokepoint 2.0.”

Senator Scott has expressed confidence in Lummis, praising her profound knowledge of digital assets and her proactive approach since day one. His comments resonate with those in the industry who view Lummis as a steadfast advocate for a sensible regulatory framework that encourages domestic innovation rather than pushing it offshore.

The composition of the subcommittee reflects a commitment to bipartisan collaboration, featuring senators from both sides of the aisle, such as Thom Tillis (R-N.C.), Bill Hagerty (R-Tenn.), and Tina Smith (D-Minn.). This diverse assembly signals a recognition that digital asset regulations affect a wide range of stakeholders and viewpoints.

Bridging the gap between political ideologies, this coalition aims to foster an environment conducive to innovation while ensuring that legislation is balanced and fair. The inclusion of voices like Senator Ruben Gallego (D-Ariz.), who serves as the ranking member, suggests a genuine effort to listen and incorporate varying perspectives into the regulatory dialogue.

The announcement of Lummis’s appointment has instigated a wave of optimism within the cryptocurrency industry. Industry leaders, including Dennis Porter, co-founder and CEO of Satoshi Action Fund, hailed it as a significant advance toward meaningful legislation that could reshape the U.S. approach to digital currencies. Former Binance CEO Changpeng Zhao has also echoed this sentiment, emphasizing the validation of a U.S. Bitcoin reserve as a vital and “pretty much confirmed” proposal.

As Lummis embarks on this new chapter in her political career, the future trajectory of digital assets in the U.S. hinges on the effectiveness of this subcommittee. Through collaboration and decisive legislative action, there lies a considerable opportunity to place the United States at the forefront of the digital asset revolution, reinforcing its role as a global leader in financial innovation. The path forward demands not only rigorous oversight but also the flexibility to adapt to an ever-evolving digital landscape.

Leave a Reply