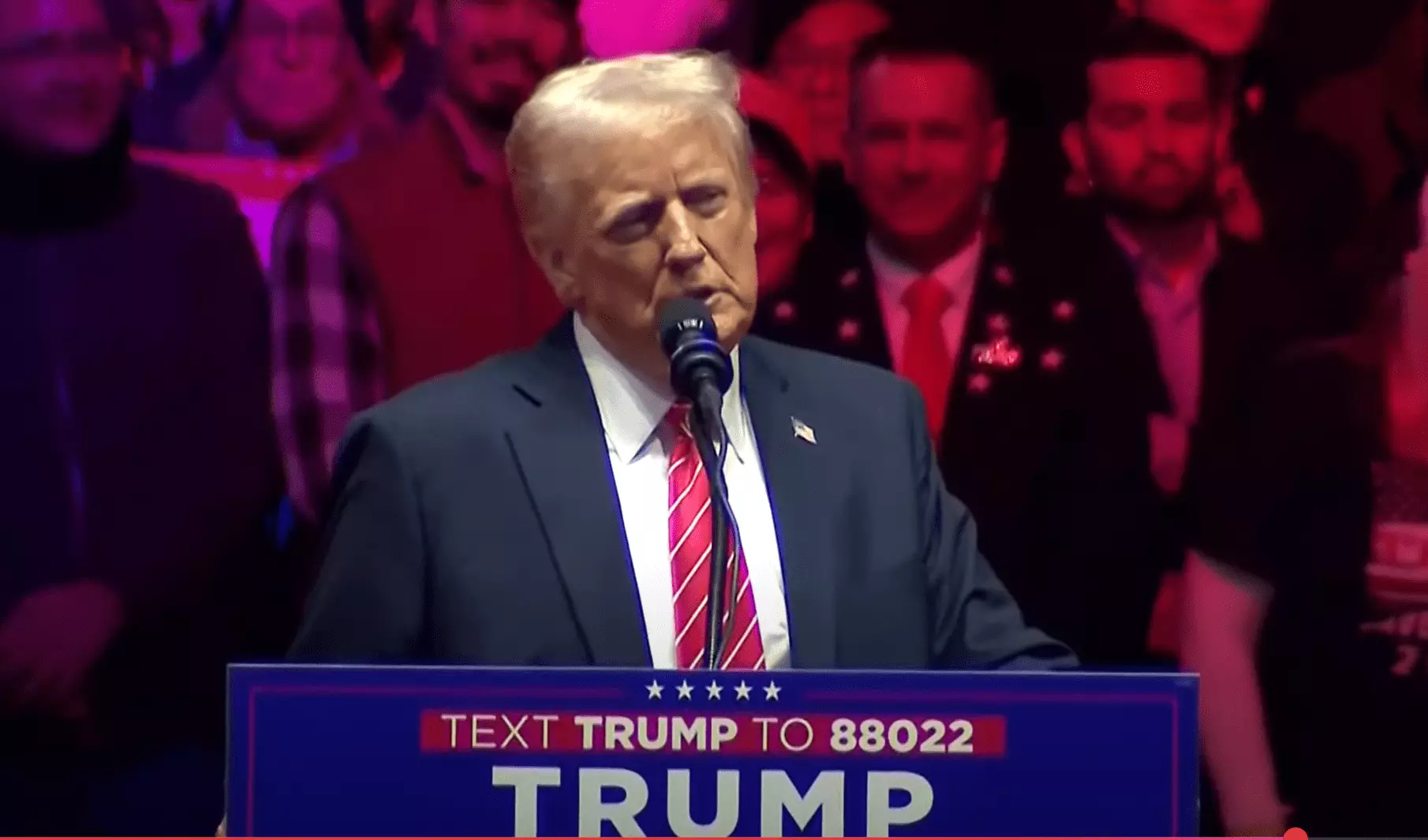

In a remarkable turn of events, Bitcoin has achieved a staggering new peak of $109,558 during the early Asian trading hours, coinciding with the inauguration of President Donald Trump. This unprecedented rise comes as whispers of a potential Strategic Bitcoin Reserve (SBR) circulate within financial markets. Trump’s entry into office has intensified speculations regarding the establishment of an SBR, possibly through an executive order—just one of approximately 100 directives he is expected to issue on his first day. Such developments have stirred considerable excitement among investors and crypto enthusiasts alike, eager to understand the implications for Bitcoin’s future.

The heightened discussions surrounding Trump’s inauguration day seem to have catalyzed investor confidence, with many observers noting the fluctuating odds of the SBR’s establishment have jumped dramatically. The crypto prediction platform Polymarket recorded a swift increase in the likelihood of an SBR forming within Trump’s initial 100 days, which surged to 59% right before Bitcoin reached its new all-time high.

Trump’s previous presidency was marked by a curious blend of skepticism and potential openness towards cryptocurrency. He had earlier suggested that the U.S. government could seize and hold Bitcoin—as evidenced by law enforcement operations targeting illicit transactions. These statements, while controversial, have kept the conversation about Bitcoin’s role in U.S. finance alive. There’s an air of anticipation regarding whether a renewed commitment to this digital asset might materialize under his administration.

Despite the lack of concrete announcements, rumors circulated that a formal executive order could be signed as early as Inauguration Day, pushing Bitcoin’s price momentum to dizzying heights. Speculation around the potential of creating a government reserve rapidly amplified following meetings held between prominent Bitcoin advocates and the incoming administration.

Meetings and Advocacy: Influential Figures Unite

Prominent figures within the cryptocurrency ecosystem have aligned themselves with lawmakers supportive of Bitcoin, including Bullish Senator Cynthia Lummis from Wyoming, who is known for her advocacy for cryptocurrency legislation. Lummis has been vocal about achieving a comprehensive legislative plan that would facilitate the establishment of an SBR and has expressed her commitment to negotiations surrounding a “Bitcoin Bill” that proposes an ambitious plan of acquiring one million Bitcoin.

The meetings don’t stop with Lummis; Michael Saylor, the chairman of MicroStrategy, is another critical player who engaged with Trump’s cabinet. His social media presence, highlighted by photos of strategic meetups with influential individuals, further exemplifies the community’s enthusiasm for potentially favorable policy changes toward Bitcoin and other cryptocurrencies.

Market Reactions and Analysis

The fervor surrounding Trump’s presidency has prompted potent discussions within the market, especially among analysts and investors. MacroScope, a noted market commentator, believes this is only the beginning: the visible interactions between the incoming administration and Bitcoin advocates signal a broader embrace of cryptocurrency that could reshape the financial landscape. Such optimism is palpable, with expectations that major announcements could emerge in the wake of these discussions.

However, seasoned investors maintain a cautious perspective. Charles Edwards, CEO of Capriole Investments, accentuates the importance of recognizing market patterns. He points out that after periods of rapid moves, Bitcoin may display significant price volatility, and thus the market’s reactions should be carefully understood. “Trust the second move,” Edwards advises, foreshadowing that inverted moves during volatile phases often set new trends.

As Bitcoin trades at $108,182 at the time of this analysis, investors remain momentarily straddling between excitement and anxiety about the future. The prospect of a strategic government reserve offers a unique opportunity for institutional growth and greater legitimacy for cryptocurrencies, but it also invites scrutiny and debate over regulation, usage, and potential market manipulation.

Thus, whether the opening of a Strategic Bitcoin Reserve under Trump leads to a sustainable growth trend or creates volatility remains a subject of keen interest among market observers. As history has shown, in the ever-evolving cryptocurrency landscape, opportunities abound alongside challenges. Investors and lawmakers alike must navigate this terrain carefully to harness the transformative potential of Bitcoin in a modern financial context.

Leave a Reply