Bitcoin, the flagship cryptocurrency, has been experiencing a significant amount of selling pressure recently. One particular event that has caught the attention of the crypto community is the transfer of $6.8 million worth of Bitcoin from a dormant wallet that had been inactive for 12 years. This transfer has raised concerns about the potential impact on the market, especially at a time when Bitcoin is already facing intense selling pressure from various entities.

The dormant Bitcoin wallet with the address 1Nxxi made its first transaction in 12 years on July 4. The wallet transferred a total of 119 BTC, valued at $6.8 million, in two separate transactions to an unknown address (3Ctd5). The fact that this wallet had been inactive for such a long period of time raises suspicions about the intentions behind the sudden transfer of funds. Many in the crypto community are speculating that the whale may be looking to sell off its holdings, which could further exacerbate Bitcoin’s current challenges.

Concerns and Speculations

The recent transactions from the dormant wallet have sparked concerns among investors and traders in the crypto space. The fear is that a significant sale of Bitcoin from this whale could result in a further decline in the price of the cryptocurrency. However, it is worth noting that the 119 BTC transferred to the unknown address (3Ctd5) is still intact, which provides some relief to the community. If the whale was looking to offload their holdings, it is likely that these tokens would have already been sent to an exchange for sale.

Apart from the dormant wallet transfer, Bitcoin is also facing selling pressure from other entities, including the German government. Reports from on-chain analytics platform Arkham Intelligence suggest that the German government has been selling significant amounts of Bitcoin, with transactions worth up to $175 million in the last 24 hours. These funds have been moved to various exchanges, raising questions about the government’s intentions with its Bitcoin holdings.

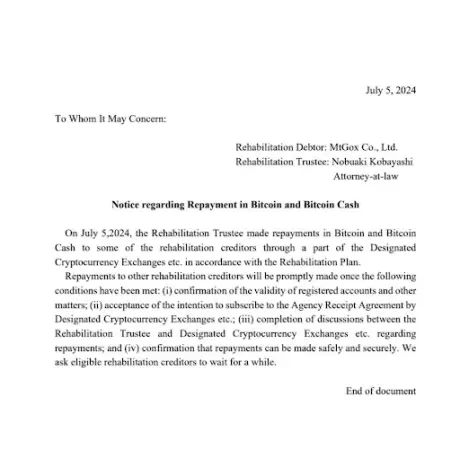

Additionally, the news of defunct crypto exchange Mt. Gox initiating repayments to its creditors is expected to add to the selling pressure on Bitcoin. The rehabilitation trustee for Mt. Gox has reportedly started making Bitcoin repayments to some creditors through designated crypto exchanges. This development could result in more Bitcoin being sold off by creditors who receive their repayments, further affecting the market dynamics.

The recent transfer of funds from a dormant Bitcoin wallet, coupled with selling pressure from other entities like the German government and Mt. Gox creditors, poses a significant risk to the crypto market. Investors and traders should remain cautious and closely monitor the situation to assess the potential impact on Bitcoin’s price and overall market sentiment.

Leave a Reply