As the landscape of cryptocurrency continues to evolve, regulatory bodies face the challenge of determining how to apply traditional financial laws to digital assets. Recently, the U.S. Securities and Exchange Commission (SEC) decided to pursue an appeal against Ripple Labs in what has become a landmark case for the crypto industry. Filed on October 2 with the Second Circuit Court of Appeals, the SEC’s appeal arises from a mixed ruling in August, which both advanced and hindered the agency’s objectives regarding Ripple’s XRP token.

The SEC initially embarked on legal action against Ripple in December 2020, alleging that the company had conducted a $1.3 billion unregistered securities offering through sales of XRP. Central to the SEC’s claims is the assertion that Ripple’s activities conflict with established securities regulations. This appeal is more than just a dispute between a company and a regulatory body; it symbolizes larger concerns surrounding regulatory clarity in the cryptocurrency sector.

A significant aspect of the August ruling, delivered by U.S. District Judge Analisa Torres, involved a dual outcome. The judge ruled that Ripple’s programmatic sales of XRP to retail investors on crypto exchanges did not breach securities laws. This part of the decision was deemed a victory for Ripple and was viewed positively by advocates within the cryptocurrency community, as it suggested a potential pathway for other tokens to contest securities status.

On the contrary, the ruling did not fully exonerate Ripple, as Judge Torres concluded that Ripple’s direct sales to institutional investors—amounting to $728 million—were indeed unregistered securities transactions. Moving forward, this segment led to a penalty of $125 million against Ripple, which fell significantly below the SEC’s initial demand for a $2 billion fine. This situation left Ripple in a somewhat paradoxical position, where they could celebrate partial success while still facing serious financial repercussions.

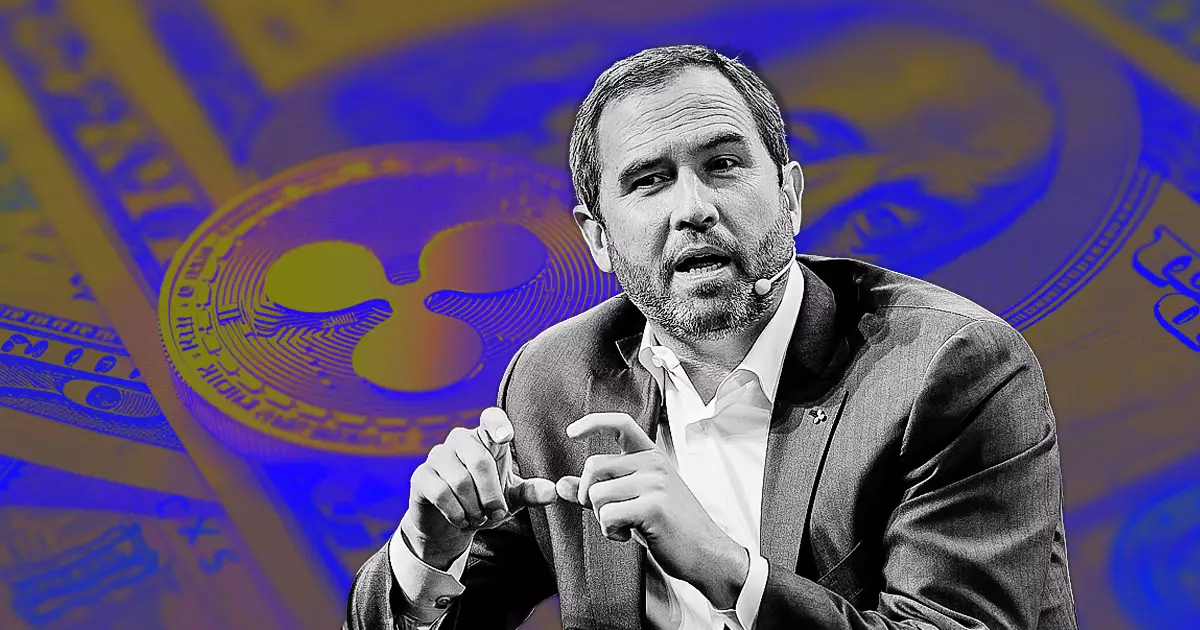

Following the SEC’s announcement about the appeal, Ripple’s CEO Brad Garlinghouse voiced frustration toward the ongoing legal entanglement. He contended that the SEC is disregarding the court’s decision and effectively wasting taxpayer resources on a case they believe they have already lost on crucial issues. Garlinghouse’s statements reflect a deeper sentiment in the cryptocurrency space—that regulatory actions can stifle innovation and burden companies that are otherwise compliant with the law.

The SEC’s appeal has not only legal implications but also economic ones. As news of the SEC’s moves reached the marketplace, XRP’s value suffered, experiencing a drop of approximately 9% shortly after the announcement. This volatility is indicative of how intertwined the fate of specific cryptocurrencies is with regulatory outcomes and broader market sentiment.

In response to the SEC’s aggressive stance, Ripple executives have voiced their intent to continue fighting back in court. Garlinghouse emphasized that XRP’s classification as a non-security remains legally upheld, regardless of the SEC’s pursuits. Furthermore, Ripple’s CLO Stuart Alderoty noted the court’s findings indicating that there were no victims in this case—an essential argument that seeks to undermine the SEC’s narrative.

The ongoing legal warfare raises critical questions about the SEC’s strategy under the leadership of Chair Gary Gensler. Instead of operating with transparency and accountability, Alderoty argued that the agency is engaging in litigation tactics that detract from judiciously applying existing laws. Ripple’s team has also hinted at a potential cross-appeal, suggesting they are prepared to further push back against the regulatory body.

This saga between Ripple and the SEC not only affects the companies involved but also has broader implications for the cryptocurrency market. As regulatory clarity remains elusive, the case continues to serve as a barometer for the health and future of the industry. The SEC’s appeal could set precedents that shape the interactions between cryptocurrency firms and regulatory agencies for years to come.

As the cryptocurrency market stands at a valuation of $2.12 trillion, with XRP ranked by market cap, developments in this legal battle will likely resonate with investors and stakeholders across the entire sector. The outcome of the SEC’s appeal could either cement Ripple’s place in the crypto ecosystem or signal more extensive regulatory hurdles that digital assets must overcome.

This ongoing conflict highlights the urgent need for clear regulatory frameworks governing cryptocurrencies. As both parties prepare for the next legal skirmish, all eyes remain on how this case unfolds and its potential ramifications for the future of digital finance.

Leave a Reply