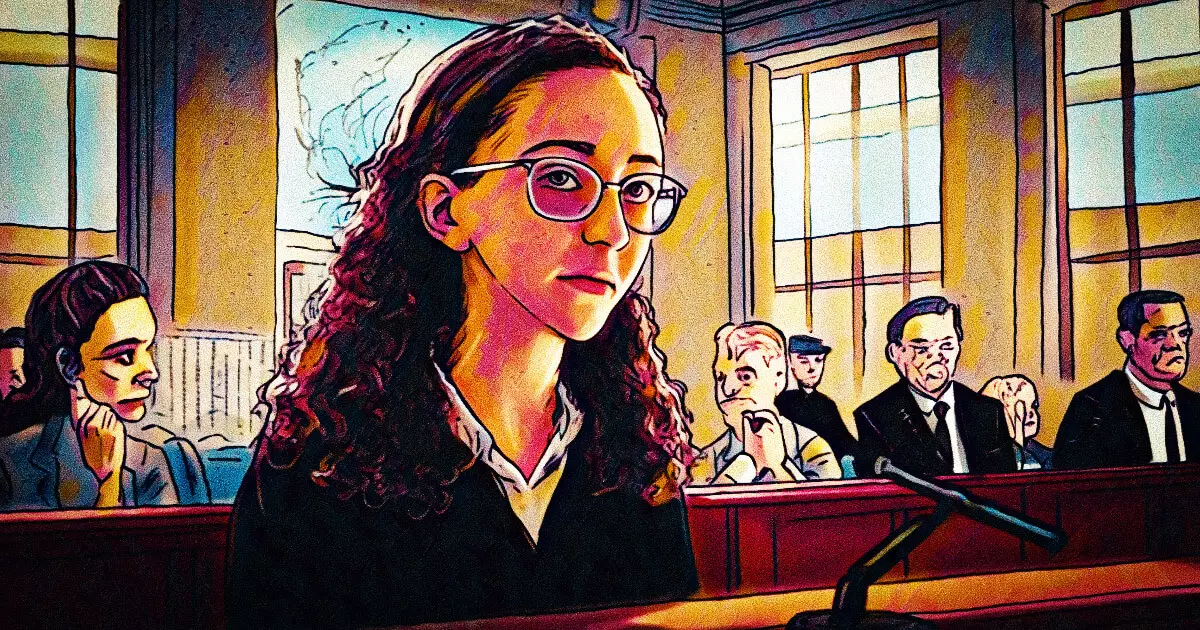

The cryptocurrency world faced a staggering upheaval with the implosion of FTX, one of the largest exchanges in this relatively new financial landscape. Central to this debacle was Caroline Ellison, former CEO of Alameda Research and a pivotal figure in the scandal. Recently sentenced to two years in prison, Ellison is now emblematic of the crisis that rocked the crypto industry. Her role in this saga raises significant questions about accountability, ethical conduct, and the precarious balance between personal relationships and professional decisions in high-stakes environments.

In a remarkable turn of events, Ellison’s legal counsel requested a leniency that would allow her to evade imprisonment, citing her extensive cooperation with authorities and critical testimony against her former partner, Sam Bankman-Fried (SBF). They argued that her insights were instrumental in piecing together the financial mismanagement that led to FTX’s collapse, a sentiment echoed by John Ray, the current CEO managing the bankruptcy proceedings. Yet, despite these arguments, the court handed down a sentence that reflected the gravity of her actions—two years in prison and an obligation to forfeit a staggering $11 billion. This ruling signifies that cooperation does not always mitigate consequences, especially in instances involving massive financial fraud.

Ellison’s defense also delved into the psychology behind her actions, suggesting that SBF’s manipulative tactics played a significant role in her decision-making. They posited that her relationships within the company created a murky moral setting, leading her to make choices that directly contributed to the collapse of FTX. This poses an interesting question about the impact of personal relationships on ethical judgment in corporate settings. Can one truly separate individual integrity from the pressures and dynamics of professional environments? Ellison’s situation reflects a broader concern that may plague many corporate leaders—how far will individuals go when entangled in complex relationships with powerful figures?

The ramifications of Ellison’s sentencing extend well beyond her personal fate; they resonate within the entire cryptocurrency sector. The FTX collapse not only undermined investor confidence but also emphasized the crucial need for regulatory oversight in an industry known for its volatility and lack of stringent governance. Moreover, with other former FTX executives awaiting sentencing, the legal repercussions of mismanagement are becoming increasingly evident. As the crypto landscape evolves, these cases may serve as a catalyst for stricter regulations to protect investors and maintain systemic integrity.

Caroline Ellison’s story encapsulates a cautionary tale of ambition, ethics, and the dire consequences of mismanagement. Her involvement in one of the most notable financial scandals in recent history forces us to consider the ethics at play within the cryptocurrency realm. As the industry matures, the lessons learned from the FTX collapse must inform future practices, spotlighting the necessity for transparent governance and ethical leadership. The ultimate question remains: can the cryptocurrency industry reform itself, or will it continue to bear the scars of past mistakes and misjudgments?

Leave a Reply