Jesse Powell, the influential figure behind the Kraken exchange, has recently expressed his support for Brian Brooks to assume the role of the next Chair of the Securities and Exchange Commission (SEC). In a post shared on November 19, Powell emphasized Brooks’ extensive background not only in cryptocurrency but also in the broader regulatory landscape. This endorsement is significant; Powell’s position in the crypto space gives weight to his claims about Brooks’ qualifications.

Powell’s critique of the current SEC reflects a growing frustration within the crypto industry. He argues that the commission has strayed from its fundamental mission, potentially harming businesses and stifling innovation in US financial markets. By advocating for Brooks, Powell underscores the need for leadership that can navigate regulatory challenges while fostering an environment conducive to growth, particularly for the crypto sector.

Brooks’ Track Record and Current Speculations

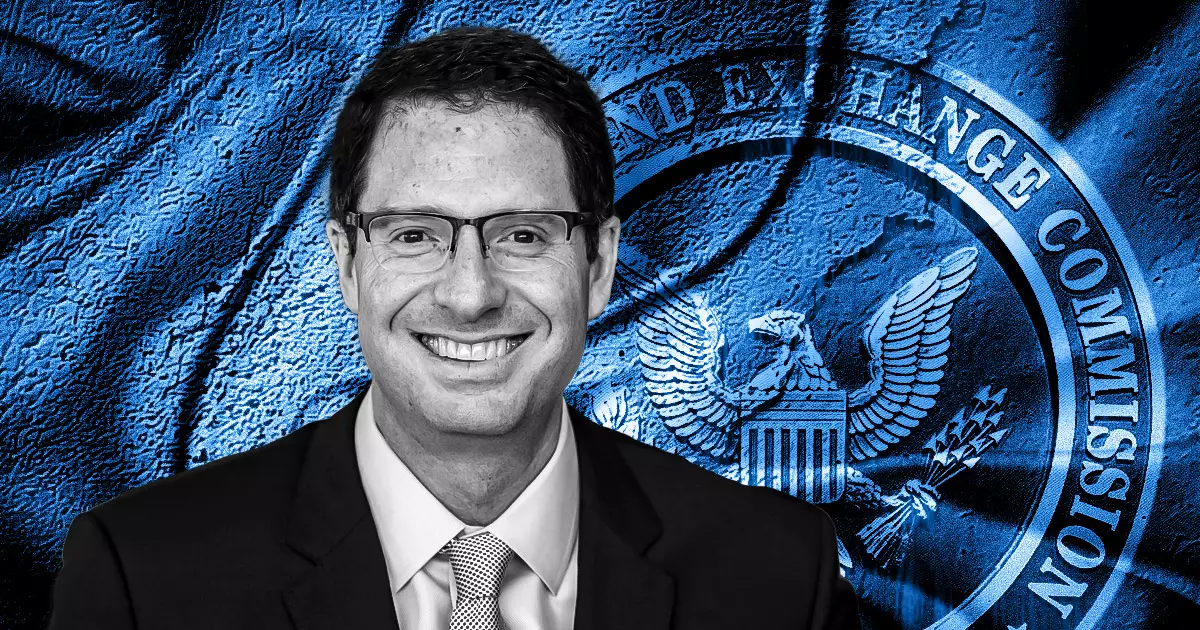

Former acting US Comptroller of the Currency, Brian Brooks, is not just a contender for the SEC chair; he is also being considered for other significant regulatory positions, including roles at the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC). His candidacy is particularly timely as the debate around the future of the SEC is heating up amid speculations about the successor to Gary Gensler.

Among the potential candidates, names like Robinhood’s Chief Legal Officer Dan Gallagher and SEC Commissioner Hester Peirce—often dubbed “Crypto Mom”—have emerged. Brooks’ standing, however, is intriguing; prediction markets currently estimate his chances of securing the role at 16%, placing him in contention with prominent figures in the finance and regulatory arenas.

An Opportunity for Progress

Brooks himself has articulated the challenges ahead for whoever steps into the role of SEC Chair under a new administration. He highlighted the groundwork laid during Trump’s first term, which included granting authorization to national banks for custodying digital assets and providing clearer regulations surrounding stablecoin reserves. These policy shifts signify a recognition of digital assets as legitimate components of the financial landscape, paving the way for future advancements.

The next SEC Chair, Brooks suggests, will have the chance to build on these significant regulatory changes. His vision for progress includes enhancing regulatory clarity for the crypto industry, which has been a point of contention amid evolving technology and market practices.

Brian Brooks’ potential chairmanship at the SEC represents an opportunity to steer the commission back to its fundamental role while accommodating the burgeoning demands of the cryptocurrency market. With growing support from industry leaders like Jesse Powell, it appears there is a call for a regulatory framework that is not only firm but adaptable enough to foster innovation and protect market integrity. As the landscape of digital finance continues to evolve, the appointment of a forward-thinking leader like Brooks could prove crucial for the future of both the SEC and the American financial market as a whole.

Leave a Reply