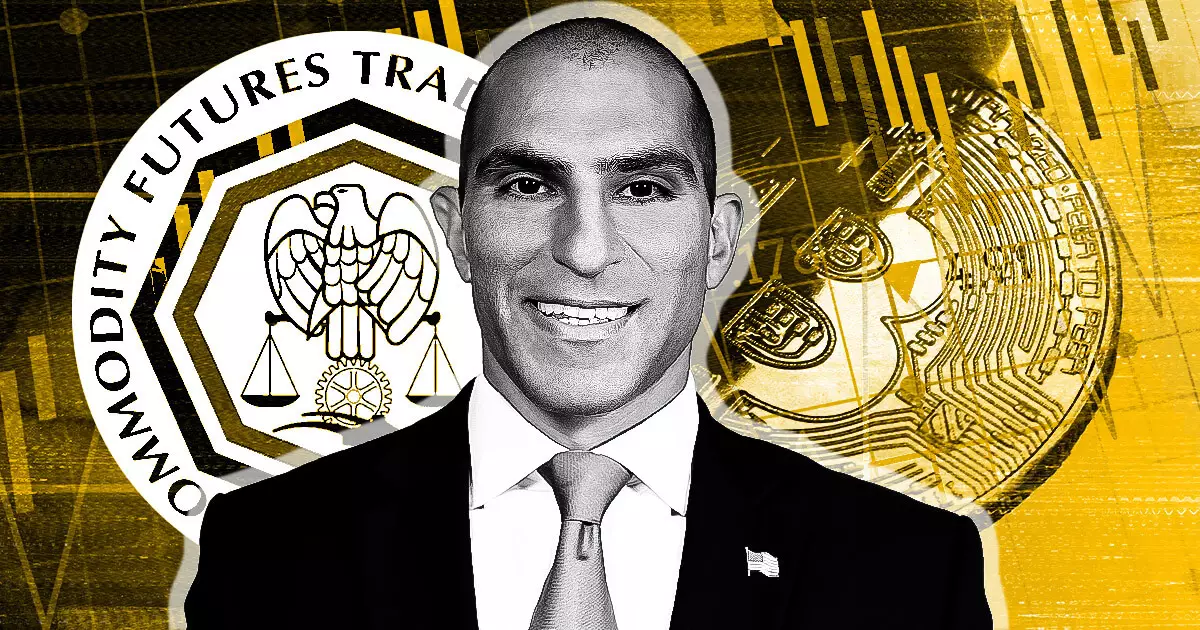

The Commodity Futures Trading Commission (CFTC) Chair, Rostin Behnam, recently expressed the agency’s willingness to take on a more significant role in regulating cryptocurrencies during a Senate Agriculture Committee hearing. The discussion, which took place on July 10, focused on the CFTC’s push for expanded regulatory powers. Senator Roger Marshall raised the question of whether it would make sense for the CFTC to become the primary regulator for digital assets, with only a few exceptions handled by the Securities and Exchange Commission (SEC). Behnam responded by indicating his support for such a shift, emphasizing the agency’s capabilities in terms of expertise and experience.

Behnam noted that in order for the CFTC to assume a primary regulatory role, adjustments to the definitions of securities and commodities would be necessary. This raises the question of how assets would be classified and which agency would have the final say in such matters. While Behnam expressed reservations about the SEC unilaterally making these determinations, he highlighted the long history of collaboration between the two regulatory bodies in defining assets with uncertain classifications.

Senator Marshall brought up the issue of potential lawsuits arising from conflicting asset designations between the CFTC and the SEC. Behnam acknowledged the possibility of legal challenges but emphasized the importance of cooperation between the two agencies in addressing novel legal questions. He stressed the need for a clear system for listing contracts that aligns with the existing regulatory frameworks of both the CFTC and the SEC to minimize delays in bringing new assets to market.

Behnam underscored the CFTC’s goal of introducing tokens and contracts to regulated markets promptly to mitigate investor risks. He argued that a significant portion of the crypto market should fall under the CFTC’s jurisdiction rather than being classified as securities. Behnam pointed out that the majority of the crypto market, around 70% to 80%, does not neatly fit into the securities category, leaving a regulatory gap that needs to be filled.

In terms of resources, Behnam highlighted the need for at least $30 million in the first year and $50 million in the second year to establish a robust regulatory regime for crypto assets. This funding would cover staffing, administrative costs, and investments in information technology. Behnam suggested that user fees from registrants could help offset the financial burden of implementing these new regulations.

Senator Cory Booker’s concerns about the urgency of expanding the CFTC’s authority were echoed by Behnam, who warned that without increased regulatory oversight, fraud and manipulation could continue to harm individuals across the US. Behnam emphasized the importance of taking proactive measures to address these risks and protect investors in the rapidly evolving crypto market.

The CFTC’s evolving stance on crypto regulation reflects a growing recognition of the need for comprehensive oversight in this emerging asset class. As the regulatory landscape continues to evolve, collaboration between regulatory agencies and a clear framework for asset classification will be crucial in ensuring the integrity and stability of the crypto market.

Leave a Reply