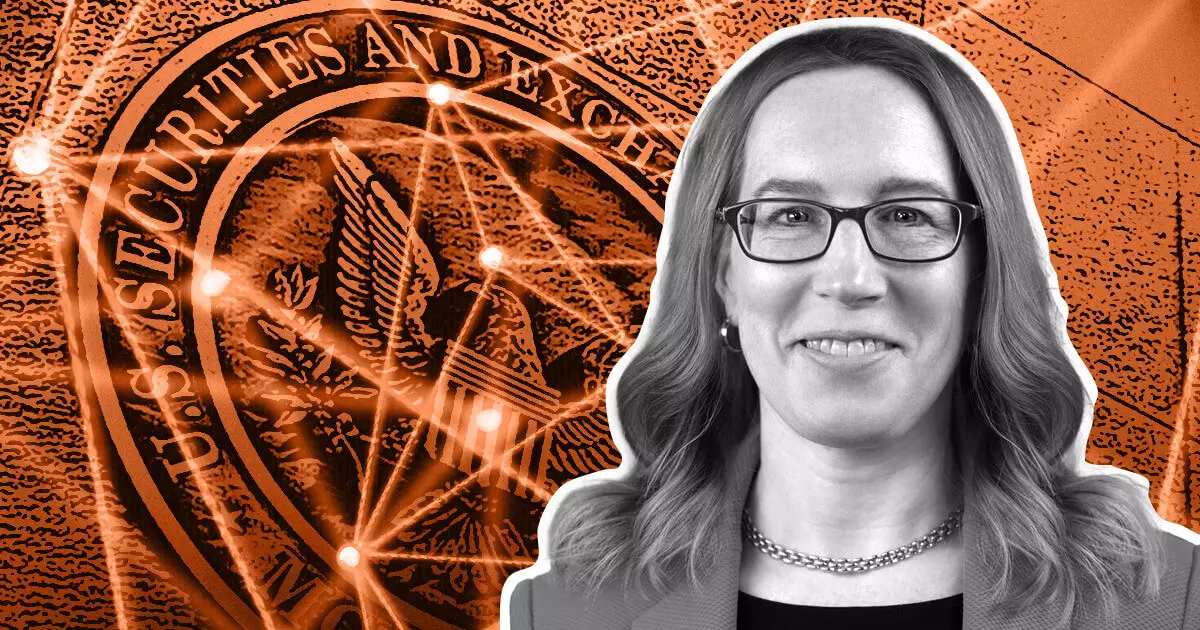

The idea of a shared digital securities sandbox between the US and the UK has been proposed by SEC commissioner Hester Peirce on May 29. This proposal aims to extend the joint digital securities sandbox (DSS) of the Bank of England and FCA to include US firms as well. The concept behind this shared sandbox is to provide a platform where participants can conduct regulatory-compliant activities in both countries and explore the use of distributed ledger technology (DLT) for securities issuance, trading, and settlement.

Under the envisioned sandbox framework, participating firms would have the liberty to operate under self-selected regulatory conditions. They would be able to utilize the sandbox environment to test their products, identify potential flaws, and gather real-world feedback from customers. The program would allow firms to build a market case for their offerings while ensuring compliance with predefined activity ceilings and anti-fraud measures.

The SEC would play a crucial role in supervising the shared sandbox initiative. Any firm that is not flagged as a “bad actor” would be eligible to participate, subject to a list of approved activities based on public feedback. The program is designed to run for a period of two years, during which participants would be required to notify their involvement and adhere to the disclosed regulatory conditions.

Peirce outlined several benefits of the proposed sandbox, citing previous success stories from the FCA sandbox in the UK. She highlighted that firms participating in the FCA sandbox between 2016 and 2019 raised more capital and had better survival rates compared to non-participating firms. Additionally, the sandbox regulators received positive feedback from a 2019 survey, indicating strong support for the initiative.

From a public perspective, the shared digital securities sandbox has the potential to introduce innovative products to consumers at an accelerated pace. By allowing firms to swiftly enter the market, the program could enhance competition and offer consumers access to a wider range of investment opportunities.

The proposal for a shared digital securities sandbox comes at a time when the SEC is facing criticism for its regulatory actions under Chair Gary Gensler’s leadership. Critics have raised concerns about the SEC’s approach towards crypto companies and its decision-making processes regarding the approval of certain financial products. Peirce clarified that her proposal is a response to industry demands and is still a “work-in-progress”, separate from any official SEC endorsement.

The idea of establishing a shared digital securities sandbox between the US and the UK holds promise for fostering innovation, enhancing regulatory compliance, and expanding market access for participants. The proposed initiative, if realized, could provide a valuable testing ground for exploring the applications of DLT in the securities industry and creating a more dynamic and competitive market environment.

Leave a Reply