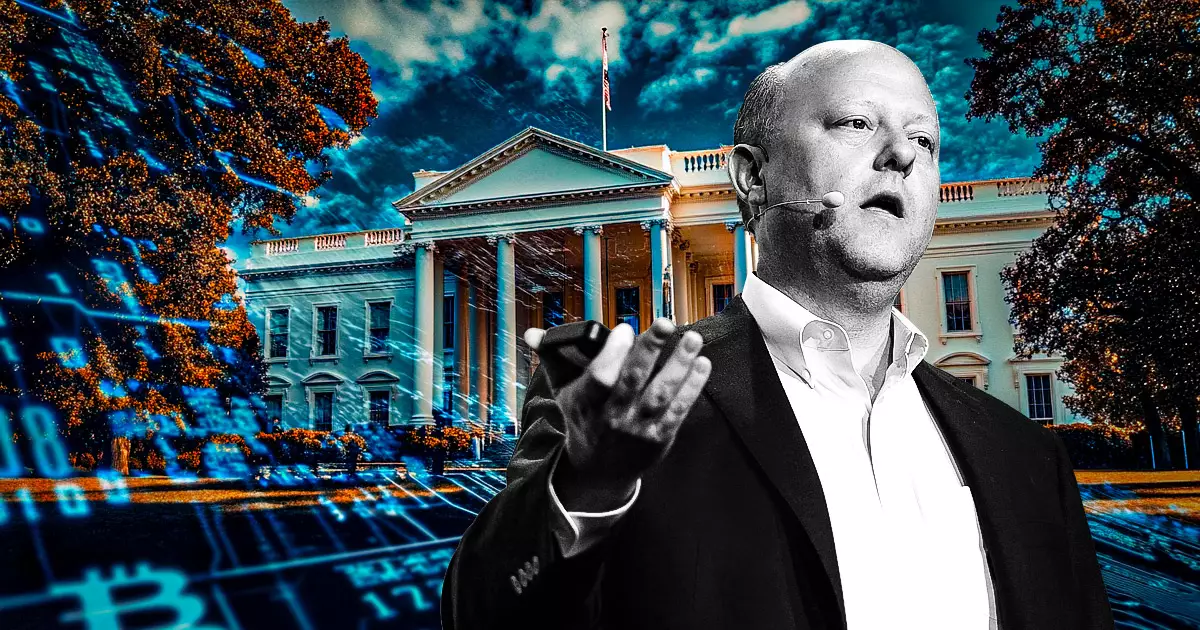

In a recent dialogue at the Reuters Global Markets Forum, Circle’s CEO Jeremy Allaire shared a hopeful perspective regarding the potential influence of President Donald Trump’s administration on the cryptocurrency landscape. Allaire argued that Trump’s policies could eliminate existing roadblocks in the digital assets arena. Notably, he referred to the SEC’s Staff Accounting Bulletin (SAB) 121 as a primary obstacle hindering the adoption of cryptocurrencies by traditional financial institutions. According to Allaire, this regulation unjustly penalizes banks for incorporating digital currencies into their financial structures and, if repealed, could pave the way for significant advancements in crypto integration.

As a leading player in the cryptocurrency ecosystem, Circle has been proactive in advocating for regulatory changes that foster innovation. The company demonstrated its allegiance to Trump’s governance by donating $1 million in USDC to his inauguration committee—an act that underscores its anticipation of favorable crypto policies. The gesture points to a broader trend among blockchain companies that are keen on aligning with political powers to stimulate growth within the industry. Nevertheless, skeptics argue that such financial backing raises ethical questions regarding the influence of corporate contributions on policy-making.

Despite Allaire’s optimistic outlook, Trump’s inauguration speech on January 20 notably omitted any discussions on Bitcoin or cryptocurrency, concentrating instead on more traditional political topics like tariffs and immigration. This absence has led to increased uncertainty among investors, stirring speculations about when substantial crypto-related policies might surface. The day saw Bitcoin’s price experiencing dramatic fluctuations, illustrating the volatile nature of the crypto market. It first reached an impressive peak of $109,000 before retracting to around $100,000, highlighting the market’s constant state of flux and investor nervousness.

The crypto sector appears to be experiencing a revival, buoyed not only by speculative trading but also by growing institutional interest. Recent figures indicate that Bitcoin exchange-traded products (ETPs) enjoyed a surge of $1.9 billion in inflows, contributing to a broader total of $2.2 billion for crypto-focused ETPs. This burgeoning institutional involvement suggests a shift in narrative regarding digital assets, moving them closer to mainstream acceptance and further integrating them into traditional finance.

Compounding this trend, the unveiling of Trump’s memecoin, TRUMP, on the Solana blockchain marked another intriguing development. The token went through a meteoric rise of 490% in just 24 hours, signifying the public’s growing engagement with cryptographic innovations. However, this rapid ascent was not without its retractions, as market corrections followed. The phenomenon reflects both the excitement and risk inherent in crypto investments, particularly when associated with high-profile individuals.

Although the idea of a strategic Bitcoin reserve remains largely speculative, betting platforms suggest that there is a significant probability of such initiatives emerging in the near future. Industry leaders maintain an optimistic stance, hoping that the Trump presidency will herald clearer regulations and expanded market opportunities for cryptocurrencies, thereby fostering greater adoption and functionality within existing financial frameworks. As economic conditions shift and the crypto market evolves, all eyes will remain fixed on the political landscape and its evolving role in shaping the future of digital assets.

Leave a Reply