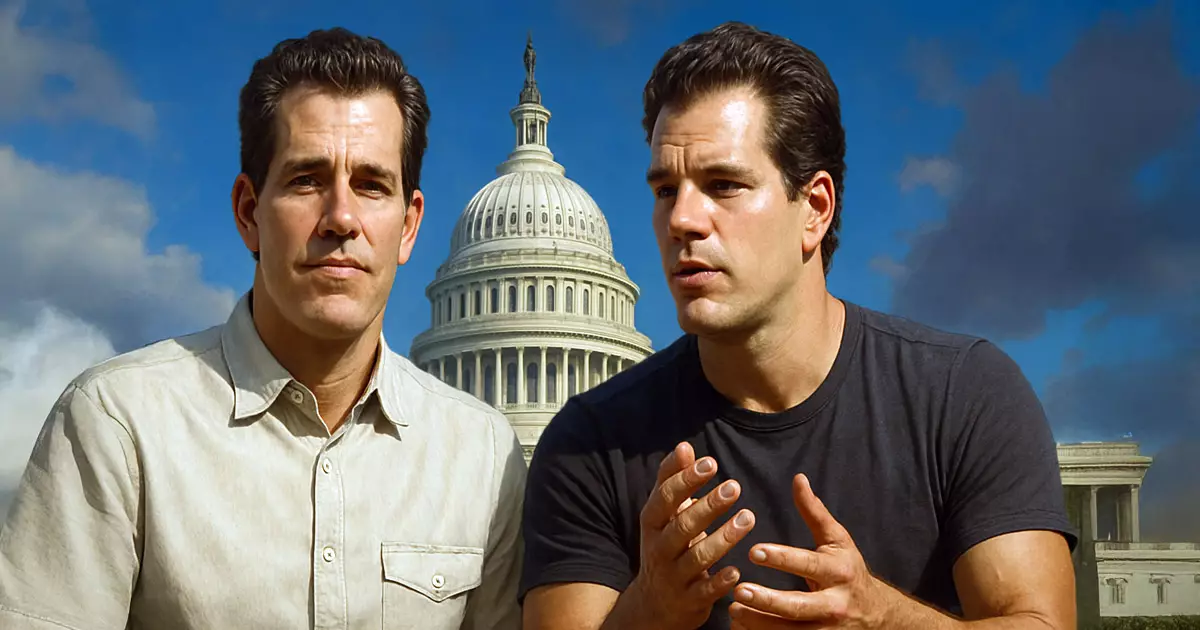

In a striking display of financial influence, the Winklevoss twins—famous for their early involvement with Facebook and later their pioneering efforts in cryptocurrency—have committed an enormous sum to shape the future of American politics. Donating over $21 million worth of Bitcoin to form the Digital Freedom Fund PAC, they have signaled a bold agenda: leverage crypto wealth to push a political vision that aligns with libertarian ideals and centered on limited government intervention. Such a move exemplifies how digital assets, previously seen merely as investments or speculative tools, are now being weaponized to influence policy and electoral outcomes directly. This infusion of capital is not just a financial maneuver but a strategic play to embed cryptocurrency into the legislative fabric of the nation.

Beyond the monetary statement, this initiative signals a broader ideological shift—the desire to carve out a distinct space where free-market principles, digital sovereignty, and minimal regulation are prioritized at the expense of traditional financial oversight. The Winklevosses, aligning with Donald Trump’s populist, center-right wing sensibilities, see blockchain technology not simply as an economic tool but as a means of reasserting individual ownership rights and resisting what they describe as “totalitarian” government overreach via Central Bank Digital Currencies (CBDCs). Their vision is predicated on a fundamental belief that the state’s expanding digital footprint threatens personal liberty and economic independence, a narrative perfectly tailored for a libertarian-leaning faction eager to resist the encroachment of government power.

Crypto-Driven Electoral Strategy: Political Battles in the Digital Age

The core of the Winklevoss-backed PAC is to actively support political candidates who champion an expansive crypto agenda—particularly in critical primaries and midterm races where control of Congress is at stake. The potential for this money to influence the balance of power is significant, given the scale of the donation and the strategic focus. The objective isn’t merely ideological; it is pragmatic. In controlling key legislative chambers, proponents hope to accelerate favorable regulations, safeguard crypto rights, and prevent government agencies from clamping down on the industry.

This approach raises critical questions about the influence of private wealth and digital assets on American democracy. While proponents argue it is about empowering individual liberties and fostering innovation, critics warn that the rise of crypto-funded politics could distort electoral fairness and create an uneven playing field—where wealth, rather than policy merit, determines influence. This is especially pertinent in a political environment where regulatory battles are intense; the PAC’s support for “thoughtful Market Structure legislation” reveals an intent to carve out a regulatory space that favors crypto startups and limits government control.

The proposed “Skinny Market Structure Bill” and the “Bitcoin and Crypto Bill of Rights” reflect a clear desire to enshrine digital ownership rights and shield industry innovation from overreach. Advocates position these measures as necessary protections to preserve economic freedom, but skepticism arises about whether such legislation might entrench special interests and inhibit future oversight mechanisms vital for consumer protection and systemic stability.

Ideology of Digital Sovereignty and Its Risks

The Winklevoss vision fundamentally rests on a distrust of centralized authority, especially regarding digital currencies like CBDCs. They consider these government-controlled assets as potential tools for tyranny—an Orwellian nightmare in the making. Their strong opposition signals an ideological stance that sees decentralization as the ultimate safeguard of liberty. However, this unyielding stance also entails significant risks. Complete resistance to regulation could create a dangerous landscape for consumers, investors, and the broader financial system. Without adequate oversight, cryptocurrencies could become conduits for illicit activities, market manipulation, or economic instability.

The emphasis on legal protections for code writers echoes a desire to foster innovation but raises concerns about accountability. While fostering entrepreneurial spirit is commendable, unregulated or lightly regulated environments can foster illegal schemes or market volatility—costs that often fall on everyday Americans. The notion that startups should operate in a “dorm room” environment ignores the complexities and risks associated with untested financial technologies.

Furthermore, positioning opposition to CBDCs as a defense of human rights may oversimplify the economic and security benefits that a well-regulated digital monetary system could offer. The libertarian ideal of unrestricted self-custody and peer-to-peer transactions overlooks the necessity of oversight mechanisms that prevent financial crimes and ensure market integrity. A balance must be struck, but the present strategy seems rooted in an all-or-nothing mentality that dismisses regulatory pragmatism as tyranny.

Challenging the Center-Right Consensus with Radical Libertarianism

Ultimately, the strategic push by the Winklevoss-led PAC signals a radical reinterpretation of American capitalism. By using their wealth to promote deregulation, oppose centralized monetary control, and influence electoral outcomes, they are pushing a version of center-right libertarianism that borders on extremism. They craft a narrative that champions individual freedom to the point of rejecting any form of government oversight—an approach that risks undermining decades of financial stability measures and consumer protections.

While the appeal to liberty and innovation resonates with a segment of the population yearning for minimal state interference, it remains fundamentally risky to a stable democratic order. Their efforts, cloaked in the language of freedom and opportunity, threaten to distort the political landscape, turning cryptocurrency from a tool of financial empowerment into a weapon for ideological conquest. This ambitious assault on the core principles of governmental regulation exemplifies a dangerous gamble—placing faith in unfettered markets over prudence, and individual rights over collective security.

Leave a Reply