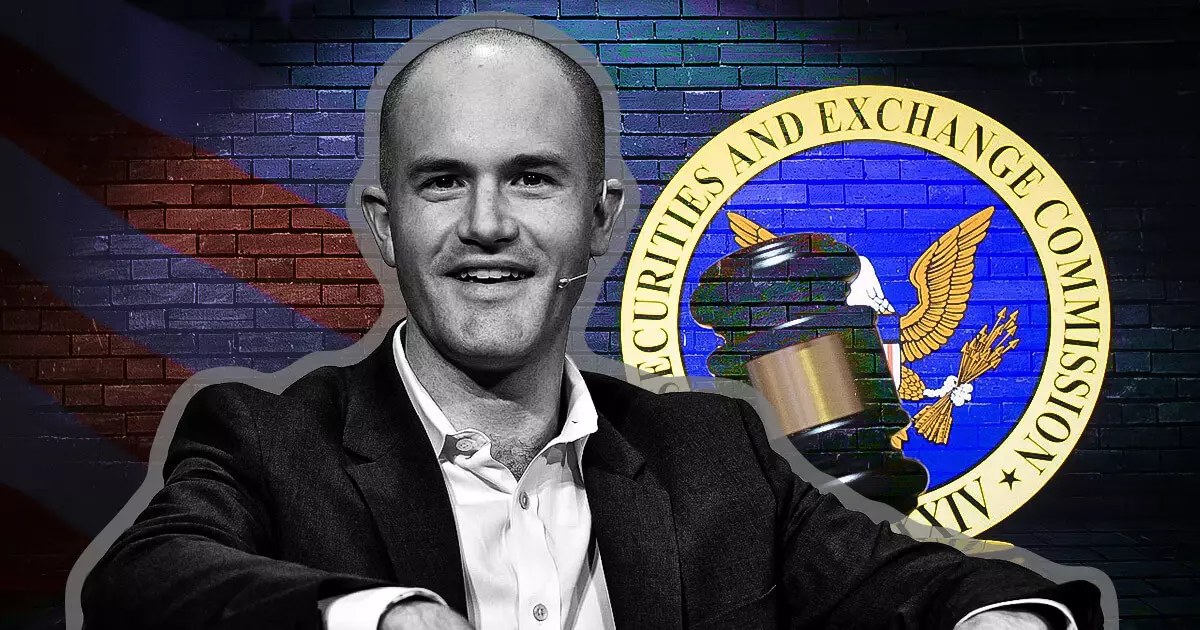

The cryptocurrency industry has long grappled with the challenge of balancing innovation against a backdrop of regulatory scrutiny. As digital assets gain traction, exchanges like Coinbase often find themselves under the microscope, facing complex legal frameworks that can stifle growth. In an increasingly tense environment, Coinbase’s CEO Brian Armstrong recently made headlines by declaring a firm stance against law firms that employ former regulatory officials, particularly targeting those he perceives to be aligned with unethical regulatory practices.

In a compelling social media announcement on December 3rd, Armstrong expressed his discontent with law firms hiring former officials from the U.S. Securities and Exchange Commission (SEC). His remarks were triggered by the recent hiring of Gurbir S. Grewal, the former Director of the SEC’s Division of Enforcement, by the Milbank law firm. Armstrong’s statement revealed his intentions to dissociate from any legal partnerships that include such hires, labeling the actions of these former officials as “unlawful” and indicative of an “ethics violation.” This stance is rooted in Armstrong’s belief that the previous SEC leadership under Gary Gensler had unjustly targeted the crypto sector without providing essential guidelines for compliance.

Regulatory Dynamics and the Crypto Landscape

Armstrong’s critique of the SEC and its previous administration reflects a broader frustration shared by many in the blockchain community. The lack of clear regulatory direction has been seen as a hindrance rather than a path to responsible innovation. With Grewal’s tenure marked by a series of aggressive enforcement actions against various crypto platforms, Armstrong’s remarks underscore the feeling of being under siege. By taking a stand against firms that support such individuals, he is not merely setting a precedent but also urging other firms to reconsider their affiliations with past regulators.

This bold maneuver by Coinbase raises significant questions regarding the future of legal partnerships in the crypto space. By declaring that employing former regulatory officials could jeopardize their collaborations, Armstrong is attempting to galvanize support from other firms in the industry, effectively urging them to take a more proactive role in holding legal institutions accountable. The CEO’s contention that “good people” opted to leave the SEC rather than partake in what he described as “normal tenure” highlights the moral and ethical dilemmas faced within regulatory institutions.

Armstrong’s declaration signifies more than just a corporate strategy; it encapsulates an urgent call for clarity and ethical considerations in the ongoing regulatory landscape surrounding cryptocurrency. As the dialogue evolves, the crypto industry must rally for clearer rules that promote innovation while ensuring compliance, thereby establishing a more robust and resilient framework for digital asset growth. Coinbase’s decision to sever ties with firms that support controversial figures is a testament to the strong undercurrent of change within the sector, suggesting a demand for accountability that resonates far beyond the boardroom.

Leave a Reply