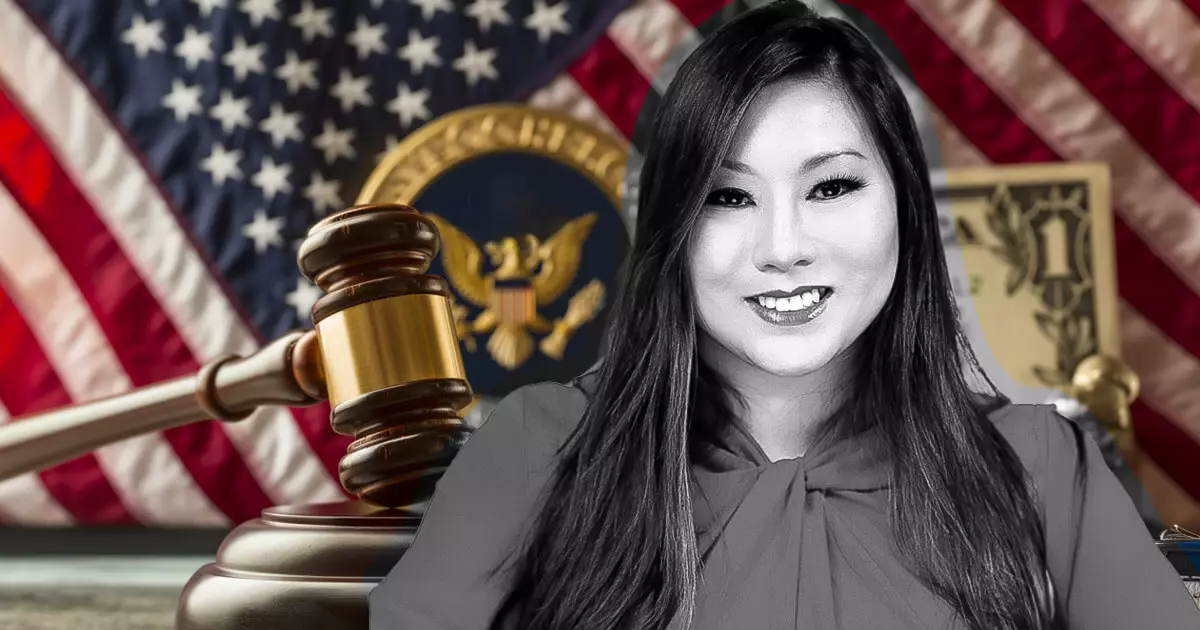

With the recent appointment of Caroline Pham as the acting chair of the Commodity Futures Trading Commission (CFTC), a significant shift in regulatory oversight within the cryptocurrency and digital asset markets is on the horizon. This appointment, reported on January 20 by Bloomberg News, reflects not only the CFTC’s alignment with the incoming administration but also the growing acknowledgment of the necessity for robust and adaptive frameworks in the cryptosphere.

Caroline Pham brings a compelling blend of knowledge and experience to her new role. Appointed by former President Joe Biden, she has quickly become known for her advocacy for clarity in the evolving regulatory landscape surrounding cryptocurrencies. Pham’s approach has emphasized the importance of innovation in regulatory practices, particularly through initiatives like “regulatory sandboxes,” which allow companies to experiment with new products in a controlled environment. This approach has gained traction as the crypto industry continues to mature and attract a wider array of participants.

During her tenure, Pham has articulated the urgent need for governments to adapt to the fast-paced world of digital finance. Her call for a government-led pilot program, which she proposed at a Cato Institute event in September 2023, underscores her belief that collaboration between regulators and industry stakeholders is crucial. This initiative aims to establish comprehensive guidelines that address risk management and transparency in the digital asset market. By fostering such engendered cooperation, Pham believes that the U.S. can not only enhance liquidity and competition but also proactively address potential risks and fraud.

Pham has also cautioned that without decisive action, the U.S. risks falling behind its international peers in implementing strategic policies concerning cryptocurrency. As countries around the globe continue to refine their approaches to digital assets, American regulators face pressure to keep pace. This concern is further amplified by the rapidly evolving nature of the crypto market, which frequently presents new challenges associated with fraud, security, and market manipulation.

As Pham steps into her role as acting chair, the implications of her leadership could be far-reaching. She embodies a vision for a regulatory landscape that balances innovation with consumer protection, a balance that is essential for the growth and stability of the digital asset ecosystem. If her initiatives gain traction, the CFTC could become a pivotal actor in defining the regulatory parameters governing cryptocurrencies, promoting an environment where industry growth is encouraged within a framework of safety and compliance.

Caroline Pham’s appointment could herald a new era for the CFTC and the digital asset market in the U.S. By championing innovative regulatory approaches and fostering productive collaboration between government and industry, Pham has the potential to set the stage for a thriving, resilient environment for cryptocurrencies that aligns with international standards. The road ahead is undoubtedly complex, but under her stewardship, there may be greater opportunities for the U.S. to lead rather than lag in the global cryptoeconomy.

Leave a Reply