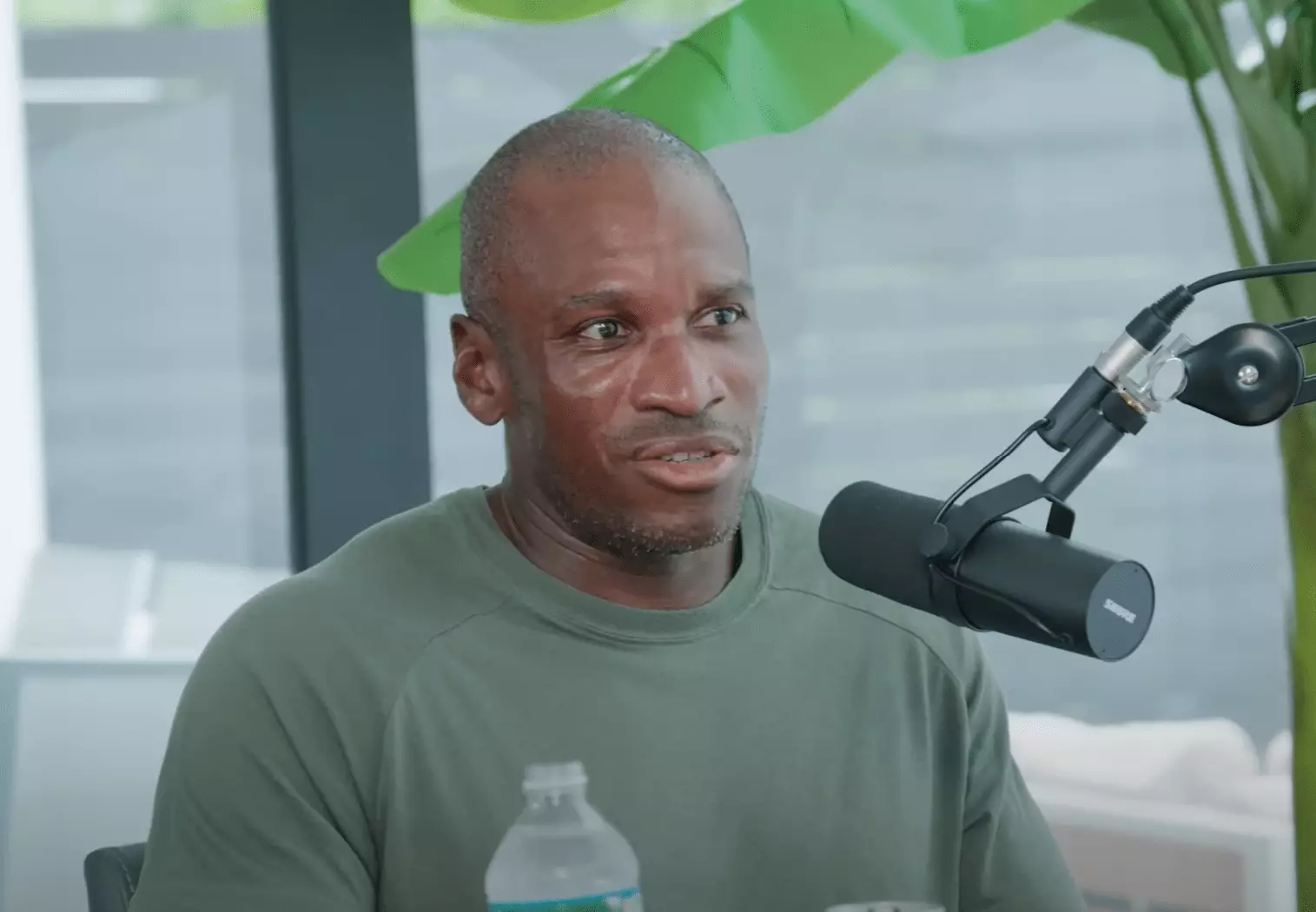

In the ever-evolving landscape of cryptocurrency, Arthur Hayes, the Chief Investment Officer at Maelstrom and a well-known figure in the crypto community as a co-founder and former CEO of BitMEX, has made a striking declaration regarding Bitcoin’s immediate future. His recent essay “The Ugly” elucidates his belief that Bitcoin is on the brink of a significant pullback, potentially diving toward the $70,000 to $75,000 range before ascending to remarkable heights—possibly reaching $250,000 by year’s end. This forecast, presented with characteristic candor, demands a closer examination of the factors Hayes believes will fuel this volatility.

One of the most compelling aspects of Hayes’ perspective is his admission of the emotional toll that market shifts can exert on traders. He likens analyzing financial trends to navigating backcountry skiing on a dormant volcano. Such an analogy vividly illustrates the sense of impending danger that can accompany market assessment. This emotional response may reflect a broader sentiment within the crypto community, particularly in light of the tumultuous events that have punctuated recent market activity, notably the downturns of 2022 and 2023. Hayes’ anxiety appears rooted in market indicators that he argues signal instability.

The mention of various financial elements—such as adjustments in central bank balance sheets, changes in banking credit, and even speculative market movements—indicates the complex web of factors that traders must navigate. Hayes emphasizes that a fall to $70,000 or $75,000 isn’t merely hypothetical but a conceivable outcome given the intricacies of current monetary conditions.

Another critical point in Hayes’ argument lies in his observations regarding central banks, particularly the Federal Reserve, the People’s Bank of China, and the Bank of Japan. He highlights that these institutions are either constraining money supply or allowing for an increase in interest rates, which could instigate a pullback in speculative capital flow. This could have substantial ramifications not only for Bitcoin but for broader financial markets as well.

Hayes posits that the potential rise in treasury yields—forecasted between 5% and 6%—may further exacerbate market instability. This scenario poses a direct challenge, particularly as the Federal Reserve enters a complex political phase with a lingering feud against former President Trump, complicating any decisions for intervention. With these tensions looming, Hayes elaborates on the possibility of a mini-financial crisis that could either compel the Fed to intervene with aggressive monetary strategies like quantitative easing or lead to a prolonged dip in asset prices, including Bitcoin.

Hayes recognizes an increasingly intricate relationship between Bitcoin and traditional risk assets. Traditional perspectives have often portrayed Bitcoin as a distinct store of value, dissociated from the dynamics of traditional finance. Yet, Hayes argues that the rising correlation between Bitcoin and benchmarks such as the Nasdaq 100 suggests a more intertwined destiny. While Bitcoin may ultimately operate independently over extended periods, it is still sensitive to shifts in fiat liquidity.

This relationship becomes particularly important when one considers how financial authorities react to market stressors. Hayes posits that Bitcoin could serve as an early indicator of distress—if bond yields increase and the equity markets shake, Bitcoin could precede these movements, offering insights for timely investment decisions.

Understanding these dynamics reveals Hayes’ investment strategy, which involves hedging against potential downturns to maximize expected value. He underscores the importance of perceived probabilities rather than certainties, arguing that a strategic retreat from risk can be more beneficial than holding steadfast in uncertain times. His framework suggests a methodical approach to investment, whereby an investor remains poised to capitalize on significant market movements, particularly when volatility presents opportunities to purchase fundamentally strong assets at attractive prices.

As Bitcoin hovers around $102,530 at press time, the question of how investors should position themselves becomes critical. Hayes’ emphasis on maintaining liquidity to seize opportunities during extreme market corrections further accentuates the need for preparedness in the volatile world of cryptocurrency.

Ultimately, Arthur Hayes’ analysis encapsulates the uncertainty that underscores Bitcoin’s immediate future. Although he anticipates a short-term decline, his long-term outlook remains bullish. The delicate balance between market forces, central bank policies, and emotional responses to volatility defines the contemporary investment landscape. As crypto enthusiasts and investors reflect on these insights, the emphasis must remain on agility and informed decision-making to navigate through the peaks and valleys that lie ahead in the cryptocurrency journey.

Leave a Reply