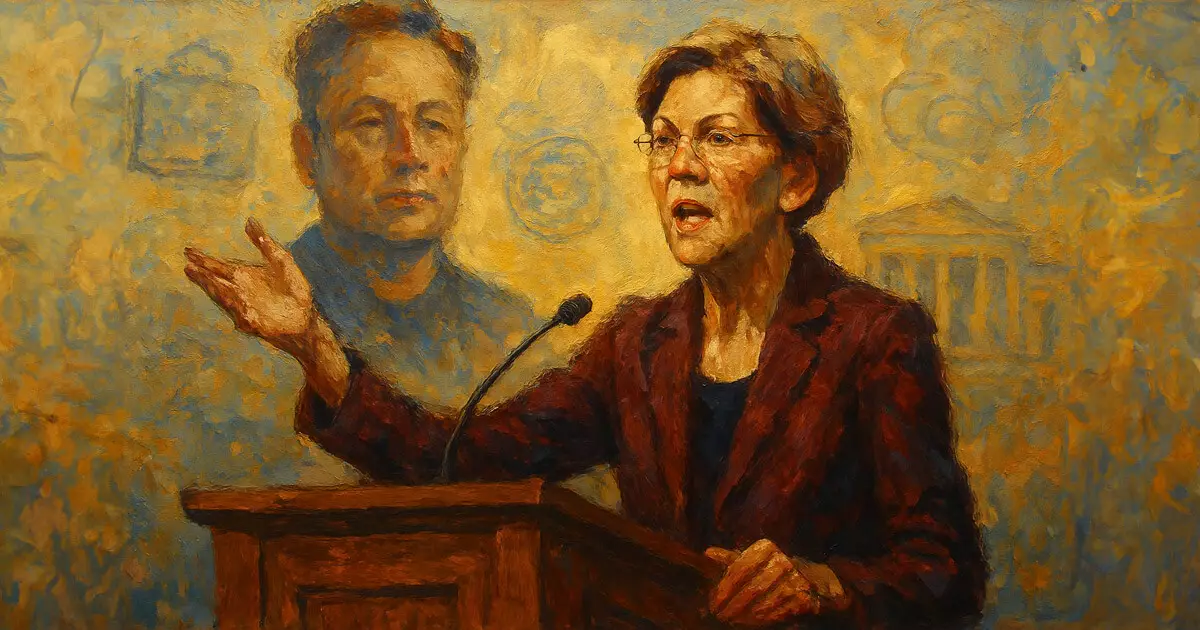

In an era marked by political polarization and mistrust, the Special Government Employee Ethics Enforcement and Reform (SEER) Act introduced by Senator Elizabeth Warren stands out as a compelling proposal designed to address the troubling intertwining of government and corporate interests. This legislation aims to enforce stricter ethics regulations for Special Government Employees (SGEs), a category that notably includes influential figures like Elon Musk. The prevailing system has created an ethical quagmire, where part-time federal workers can engage with private industry while holding significant influence over government policy. By mandating enhanced transparency from SGEs, the SEER Act targets the shadows where potential conflicts of interest lurk, where decisions affecting public welfare may be swayed by corporate ties.

Raising the Stakes on Transparency

At the heart of the SEER Act is a vital push for greater accountability. Currently, SGEs are allowed to operate with minimal disclosure of their financial interests unless they exceed a specific salary threshold. This loophole has become a breeding ground for ethical ambiguity, especially for high-profile advisors like Musk, who blushes with government contracts while sidestepping the rigorous disclosures that full-time officials must follow. The SEER Act’s proposition to require transparency from these employees aligns with democratic ideals; it fortifies the expectation of ethical governance and seeks to safeguard taxpayer interests. No longer should wealthy moguls be allowed to navigate within a vague ethical terrain while enjoying lucrative government contracts.

Broad Support for a Necessary Reform

What’s compelling about the SEER Act is the breadth of support it has garnered from an array of advocacy organizations. Groups such as Public Citizen and Citizens for Responsibility and Ethics in Washington champion the need for heightened scrutiny of advisors who operate in close proximity to government bureaucracy. This diverse coalition reflects a growing consensus: regardless of political affiliations, individuals on either side perceive the blurring lines between corporate interests and public welfare as increasingly untenable. In a world where trust in government wanes daily, enacting a reform that aims to uplift ethical standards is not only desirable; it is imperative.

Setting Impromptu Limits on Corporate Influence

The SEER Act takes a bold step by proposing that SGEs be prohibited from securing outside compensation for their private roles once their time in office exceeds 130 days. This provision signals a serious effort to curtail the undue influence of corporate leaders on federal policy. Imagine a scenario where a corporate titan, deeply embedded in multiple industries, leverages their advisory role to push agendas that may disproportionately benefit their bottom line. The SEER Act intends to end such practices, ensuring that public policy decisions are free from the subtle manipulation of corporate interests operating behind the scenes.

Public Access to Ethical Oversight

One of the key innovations of this legislation is that it promises to increase public oversight by requiring all conflict-of-interest waivers for SGEs to be publicly accessible. This transparency would empower both citizens and watchdog organizations to hold these advisors accountable. An informed public is a crucial defense against potential ethical breaches, as it creates an environment where scrutiny can flourish. By creating a public database detailing SGEs’ days served and their nature, the SEER Act fosters a sense of responsibility among these advisors who will no longer operate under the cover of obscurity.

The SEER Act is not just a political maneuver but a necessary recalibration of the ethical compass guiding government advisors. The potential for this legislation to reshape the ethics landscape in U.S. governance is profound and necessary, appealing to a broader call for transparency, accountability, and integrity within the heart of our institutions.

Leave a Reply