Recent developments in the cryptocurrency sector signal an intensified interest in public listings, highlighted by Gemini’s exploration of an initial public offering (IPO) as reported by Bloomberg News. This strategic move appears to be part of a broader trend within the cryptocurrency exchange ecosystem, with several firms considering going public in the coming years. Analysts suggest that favorable political sentiments, particularly with the Trump administration’s pro-crypto agenda, are motivating these companies to pursue IPOs, setting the stage for a possible transformation within the financial landscape.

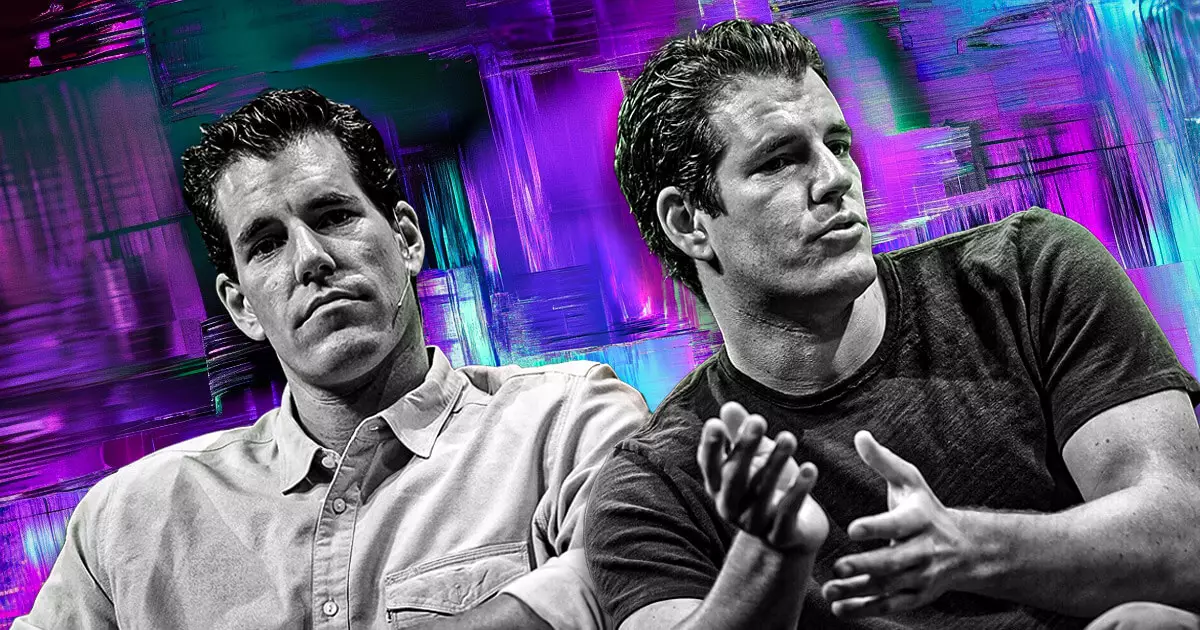

Gemini, co-founded by Cameron and Tyler Winklevoss, has gained significant attention, not only for its innovative platform but also due to its influential founders. As indicated by Federal Election Commission filings, the Winklevoss twins have actively supported political efforts that align with their business interests, including donations of Bitcoin to Trump’s campaign. While the brothers’ commitment to political alliances could be construed as a bid for favorable regulatory treatment, it also opens up vital discussions about the intersection of politics and cryptocurrency. The recent regulatory scrutiny faced by Gemini, including a $5 million settlement with the Commodity Futures Trading Commission, underscores the precarious balancing act that crypto firms must navigate between compliance and ambition.

The landscape for crypto exchanges has been increasingly fraught with regulatory hurdles. Gemini’s decision to exit the Canadian market—an action echoed by other firms such as Bybit and Binance—illustrates the challenges that arise in jurisdictions with stringent regulations. In contrast, Gemini’s recent achievements in securing a license in Singapore showcase its ability to pivot and adapt within an evolving regulatory environment. The company’s strategy to offer cross-border money transfers and digital payment services in a country known for its favorable stance on crypto initiatives is a proactive move that could result in significant growth opportunities.

With increasing momentum towards IPOs among cryptocurrency players, including Bullish Global—a digital asset exchange backed by billionaire investor Peter Thiel—Gemini’s potential public listing could catalyze broader acceptance of cryptocurrency enterprises by traditional investors. The interplay between regulatory compliance, strategic market positioning, and political support is critical as these firms seek to solidify their standing in the financial ecosystem. As the cryptocurrency market matures, the viability and success of IPOs will likely hinge on how effectively these companies can manage the complexities inherent in their operation.

As Gemini navigates a complex landscape riddled with challenges and opportunities, its potential IPO may signal not just a new chapter for the exchange, but for the cryptocurrency industry as a whole. The overall trend toward public listings augurs well for increased legitimacy and participation in the crypto market, potentially reshaping how these digital assets are perceived by investors and regulators alike.

Leave a Reply