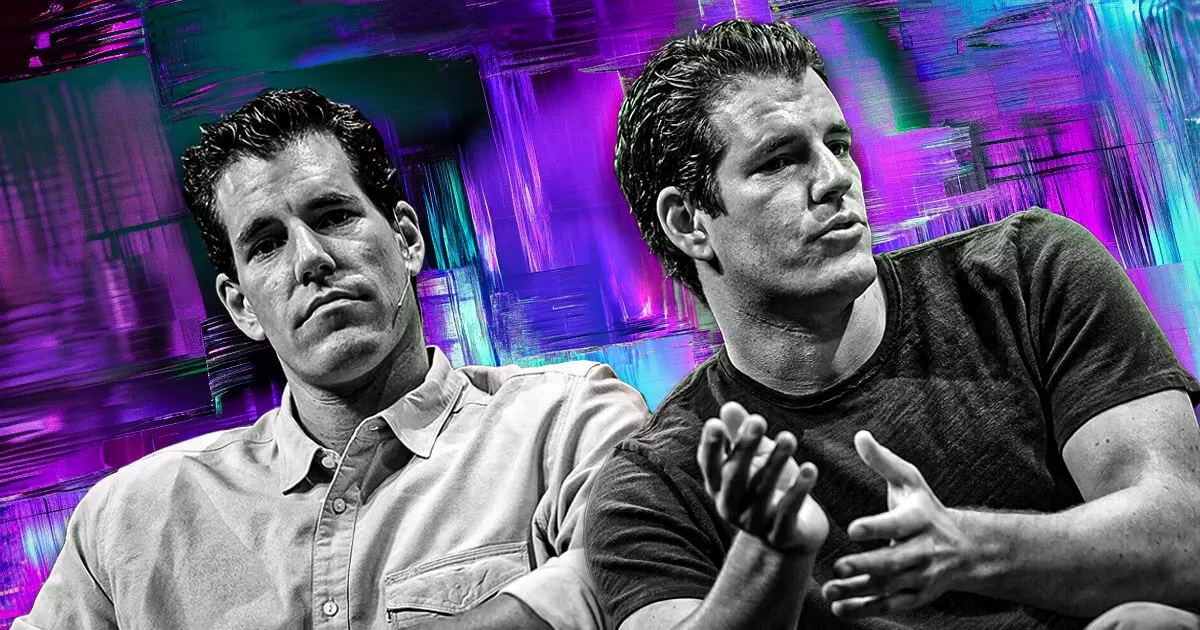

In a significant move that has reverberated throughout the cryptocurrency landscape, Gemini, a prominent cryptocurrency exchange, has announced it will cease hiring graduates and interns from the Massachusetts Institute of Technology (MIT). This decision stems from MIT’s recent decision to welcome back former Securities and Exchange Commission (SEC) Chair Gary Gensler as a Professor of Practice. The Winklevoss twins, co-founders of Gemini, voiced serious concerns over Gensler’s association with MIT, equating it with a broader ideological clash within the cryptocurrency sphere.

Tyler Winklevoss took to social media platform X, explicitly stating that as long as MIT maintains ties with Gensler, Gemini would not hire MIT graduates or interns. His choice to highlight this drastic policy change signals a growing rift between influential players in the crypto industry and academic institutions perceived as unsupportive of the sector. Similarly, his twin brother Cameron echoed these sentiments, labeling Gensler an “expert in failed public policies,” fundamentally criticizing MIT’s decision to reinstate him despite his contentious regulatory history.

Gensler’s role at MIT involves undertaking research in critical areas such as artificial intelligence, finance, and public policy, while co-leading the FinTechAI@CSAIL initiative. His return to academia has reignited existing tensions within the crypto industry, especially given his reputation for strict regulatory measures during his tenure at the SEC. The fact that the crypto industry views Gensler not merely as an academic but as a figure emblematic of regulatory overreach underpins the intensity of this backlash.

The ramifications of Gemini’s bold decision may extend beyond the company itself. Paradigm co-founder Matt Huang’s call for MIT-connected crypto professionals to rally against the institution hints at a potential higher-level strategy within the industry to combat perceived regulatory oppression. Caitlin Long, CEO of Custodia Bank, raises a pertinent question—could this be the precursor to a larger movement where crypto firms start distancing themselves from universities that welcome figures perceived as regulatory roadblocks to innovation? The questioning of MIT’s engagement with Gensler suggests a brewing sentiment reminiscent of previous calls for boycotts against legal institutions that allied themselves with regulatory figures seen as hostile to the crypto ecosystem.

The friction between Gemini and MIT represents more than just an employment policy; it encapsulates broader debates about the role of regulatory figures in academia and their impact on innovation. As the cryptocurrency industry grapples with regulatory challenges, the stances taken by influential players like the Winklevoss twins may resonate widely, potentially inspiring collective actions that could reshape interactions between tech innovators and traditional academic institutions. If the crypto community starts taking coordinated action against perceived regulatory biases, it could lead to a notable shift in how universities engage with former regulators involved in crafting policies they believe suppress innovation rather than promote it.

Leave a Reply