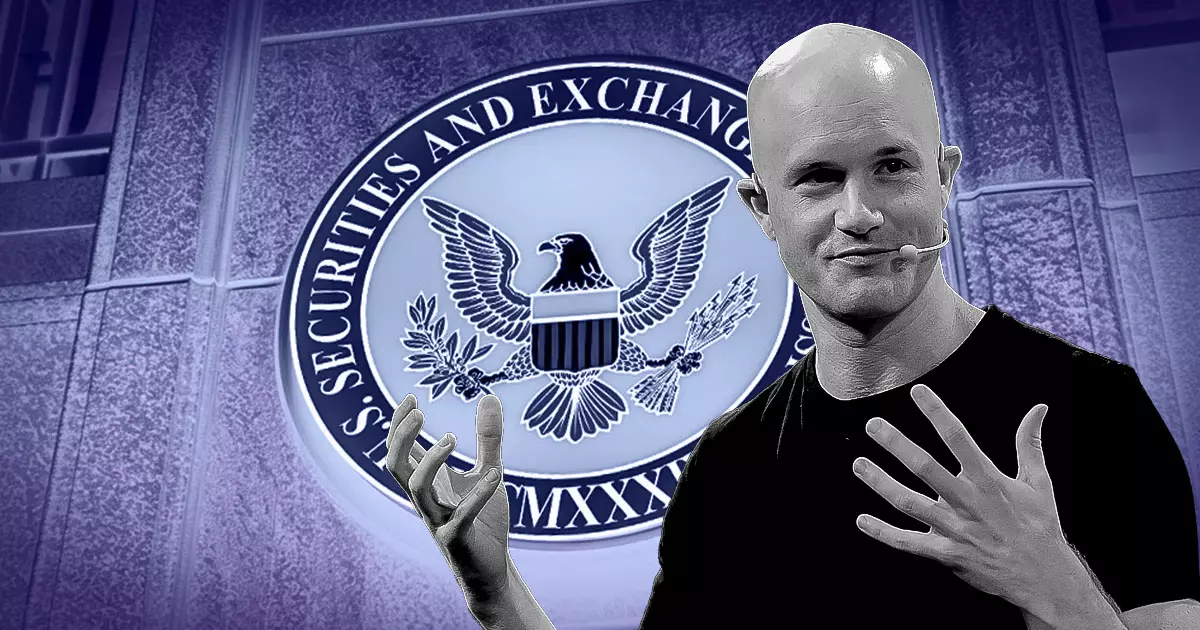

Brian Armstrong, the CEO of Coinbase, has recently raised an urgent call for introspection within the U.S. Securities and Exchange Commission (SEC). His critique comes as the SEC finds itself under growing scrutiny for its handling of cryptocurrency regulation. Armstrong argues that the next SEC Chair should not only halt what he describes as “frivolous” litigation against crypto companies but also publicly acknowledge the agency’s shortcomings. Such a move, he believes, could facilitate the rebuilding of trust between the SEC and the public, despite the acknowledgment that this act alone cannot erase the pre-existing harm done to the industry.

The Inconsistencies of SEC Regulations

Under the leadership of Gary Gensler, the SEC’s approach to regulating digital assets has been characterized by significant inconsistencies. Armstrong highlighted a crucial contradiction: the agency’s evolving stance on whether digital assets are classified as securities has been confusing at best. In 2018, the SEC made it clear that digital assets do not meet the criteria for securities. However, this assertion was reversed in 2021, only to face another shift in 2024. This oscillation has left not just companies but also investors bewildered about the regulatory landscape concerning cryptocurrencies.

The SEC’s handling of Bitcoin illustrates this uncertainty further. Initially classified as a non-security in 2023, the agency later expressed ambiguity regarding its status before reaffirming its non-security classification the following year. This lack of a cohesive and consistent regulatory framework poses serious challenges for the cryptocurrency sector. Companies are left grappling with shifting regulatory demands, which stifles innovation and growth within the industry. Armstrong’s insights into the SEC’s erratic stance underscore a pressing need for clarity and certainty in regulatory practices.

Armstrong also raised alarming questions regarding the SEC’s authority over digital asset exchanges. The agency’s narrative has shifted from claiming that no regulatory framework existed for such exchanges to asserting that it has the authority to oversee them just a year later. These contradictions not only confuse cryptocurrency firms but also exacerbate regulatory challenges, leading many to advocate for significant changes in leadership and approach within the SEC.

The broader call from the cryptocurrency sector, as expressed by Armstrong, is for transparency in regulatory practices. The SEC’s conflicting statements on securities laws have triggered widespread calls for reform and accountability. There is growing momentum among industry advocates to push for a new direction for the SEC, one that ensures clarity and consistency that can foster an environment conducive to innovation. With figures like Donald Trump promising to address the leadership of the SEC if elected, the landscape for cryptocurrency regulation may be on the brink of a significant transformation.

Through these developments, Armstrong emphasizes the crucial importance of public trust in regulatory institutions, highlighting the need for a re-evaluation of the SEC’s strategies and policies to better align with the elements of accountability, transparency, and consistent guidance.

Leave a Reply