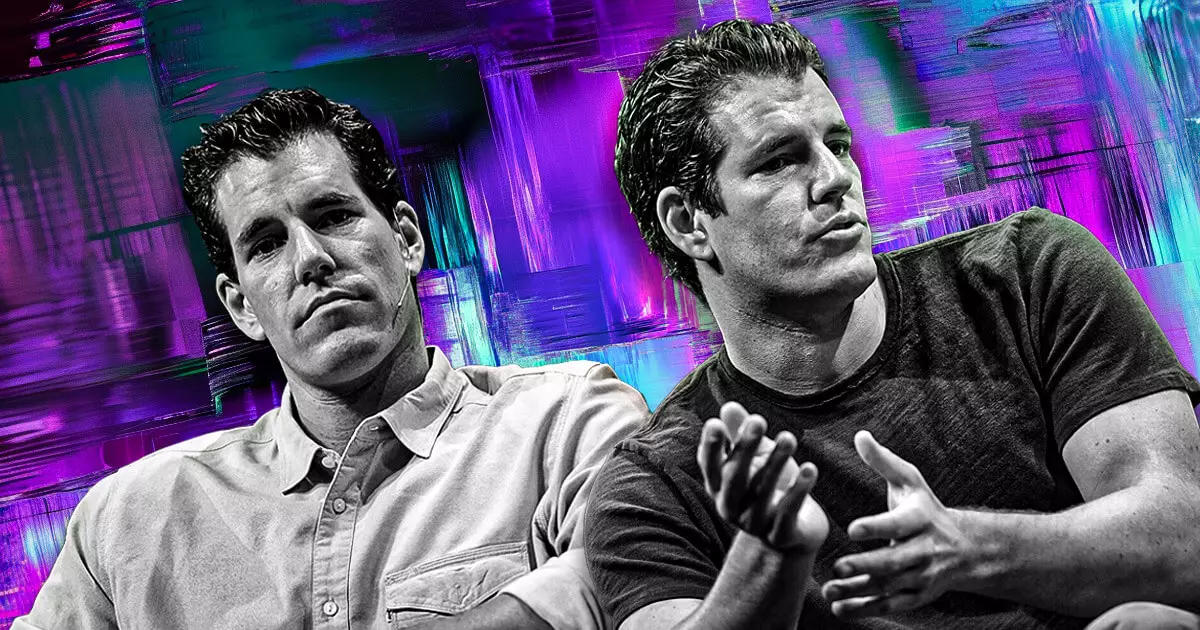

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, has strategically filed for an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC). This monumental move comes at a time when public interest in cryptocurrencies is burgeoning and the regulatory framework is evolving. The filing signals a strong intention to become a leader in the digital financial landscape, setting the stage for how cryptocurrencies may be perceived by mainstream investors and institutions in the years to come.

The Implications of SEC Engagement

While the road to IPO often riddled with obstacles, Gemini’s path is reflective of a broader trend within the digital asset sector. The need for transparency and regulatory compliance is amplified by the current climate of skepticism towards cryptocurrencies. As Gemini awaits feedback from the SEC and prepares to synchronize its financial disclosures, the attention could catalyze a positive reassessment of digital assets among traditional investors. This process could establish a crucial precedent, showcasing that with diligence and adherence to guidelines, cryptocurrency platforms can thrive in adherence to regulatory expectations.

Market Dynamics and Timing

The crypto market has faced headwinds, but the timing of Gemini’s IPO filing may not be coincidental. In light of Circle’s recent successful debut on the New York Stock Exchange, the mood surrounding public offerings in the region may be set for a bullish trend. Circle’s stock performance, climbing from an initial price of $31 to $119.21 within a short span, indicates soaring investor optimism. Such figures provide a narrative to other digital asset companies, like Gemini, suggesting that now could be the opportune moment to pursue market entry – particularly to attract institutional capital eager to engage with burgeoning technologies.

Institutional Interest on the Rise

The landscape is evolving, with financial heavyweights positioning themselves to capitalize on the digital asset frontier. The backing of banks such as Goldman Sachs and JPMorgan, reportedly guiding Kraken towards its own IPO, underlines a potential influx of institutional interest. This rising tide means that firms projecting profitability and solid operational frameworks could find favorable reception, aligning investor confidence with appetite for cryptocurrency-related ventures. As businesses like Gemini and Kraken gear up for public exposure, a cultural shift towards legitimizing digital assets in traditional finance is palpable.

The Ripple Effect on the Crypto Ecosystem

Gemini’s IPO could usher in a new era where successful public offerings by crypto exchanges invigorate the entire ecosystem. The observable effects of Circle’s IPO might propel other private firms to initiate discussions around their own public allocations. With institutional investors watching, the dynamics of supply and demand could transform existing valuations and foster healthier competition among exchanges while driving innovation in services offered. This competitive environment promises to enhance user experiences and improve liquidity across the board.

As Gemini prepares to enter the public market, it embodies both the spirit of innovation and the challenges of regulatory scrutiny. The upcoming IPO highlights the accelerating adoption of cryptocurrency in the investment realm, paving the way for an exciting but complex future. While optimism prevails, it is crucial to remain aware of the solidifying scrutiny that the sector faces and how that could shape investor expectations and market movements.

Leave a Reply